The Coronavirus, Aid, Relief, and Economic Security Act (CARES Act) and Families First Coronavirus Response Act (FFCRA) contain many federal tax changes, which we reviewed back in May.

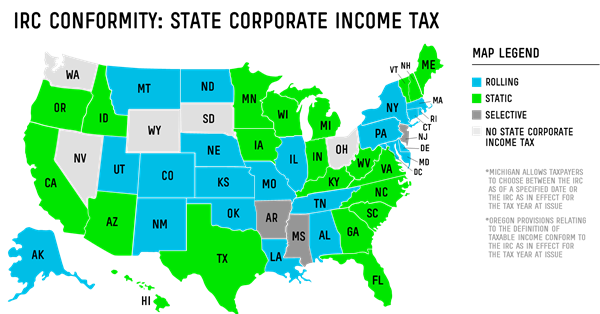

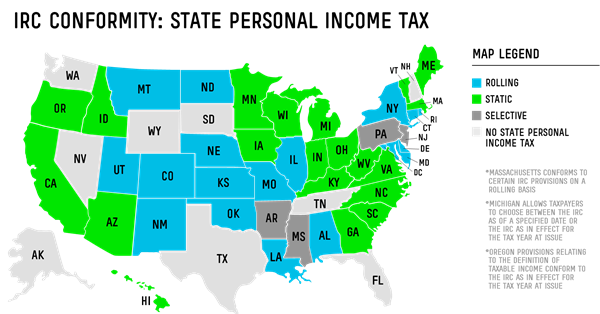

These federal tax changes invariably affect your state and local tax (SALT) obligations, and thus it is important to understand whether or not (or to what extent) states and localities adopt such federal tax changes. Most states and localities have adopted varying “conformity” laws, which can be categorized broadly into three groups: rolling, static, and selective. Herein we use the popular acronym, SALT, for convenience, but localities do not necessarily follow the states in which they exist, so it is important to check each jurisdiction.

- Rolling conformity means that SALT conforms to the IRC as it is currently in effect. When a change happens on the federal level, SALT automatically mirrors and adopts the change, unless the state or locality takes action otherwise to de-link state or local law from the IRC.

- Static conformity means that SALT only conforms to the IRC as of a certain date, if the state or locality passes new legislation to adopt the federal changes.

- Selective conformity means that SALT may have rolling conformity as to certain IRC provisions and static conformity as to others. To find out whether and to what extent a federal tax change affects your state or locality, analysis of the particular provisions is required.

Below are two maps showing these three categories of states, for both corporate and personal income tax. COVID-19 has created or significantly increased state and local budget deficits, and consequently many of those jurisdictions are looking to de-couple from federal tax law in whole or in part as a means of dealing with these deficits, and some of these jurisdictions have already proposed bills to do so. Therefore, it is important to consult with a tax professional to get the latest information regarding these potential changes, as they could change the maps below.