Most public companies have developed long-term compensation programs that measure performance metrics over time (often over three years), and that typically reward senior executives for meeting clearly identified benchmarks. These plans seek to align the interests of employees with those of owners (i.e., shareholders in the public markets). Alignment, along with the retentive value of long-term incentives, has proven to be a successful way to ensure “pay-for-performance” and continuity within an organization.

But what about the compensation plans within private companies, including family offices? Whether led by a family member or another governance structure, a comprehensive compensation program that aligns stakeholder interests is critical to a successful organization. Following the public company model, rewarding key executives for value enhancement is the cornerstone of a pay-for-performance approach to compensation planning. Pay-for-performance clearly incents internal stakeholders and aligns the interests of the family office in providing the capital for those who are directing its investments (and upon whose performance the compensation depends). Further, pay-for-performance has become an integral tool for family offices to attract and retain top talent.

Pay-for-performance

Most compensation programs have a three-pronged goal to incent, motivate and retain. Prudent investment, coupled with a properly structured compensation program, enables organizations to satisfy those three prongs because the ability to tie compensation directly to profitability incents and motivates and is often an expectation of top talent. The long-term nature of many family office investments fosters retention.

Here are some key considerations and best practices for the development of compensation plans that enable family offices to engage and retain top level talent.

Compensation factors

A well-thought-out compensation structure for executives comprises three elements: base salary, annual bonus, and long-term incentive plans (LTIPs):

- Base salary. Seemingly obvious, but meaningful base compensation rewards a professional’s time and efforts since, without guaranteed success of every initiative/transaction, compensation cannot be solely tied to successful outcomes. Otherwise, most professionals will seek to limit risk.

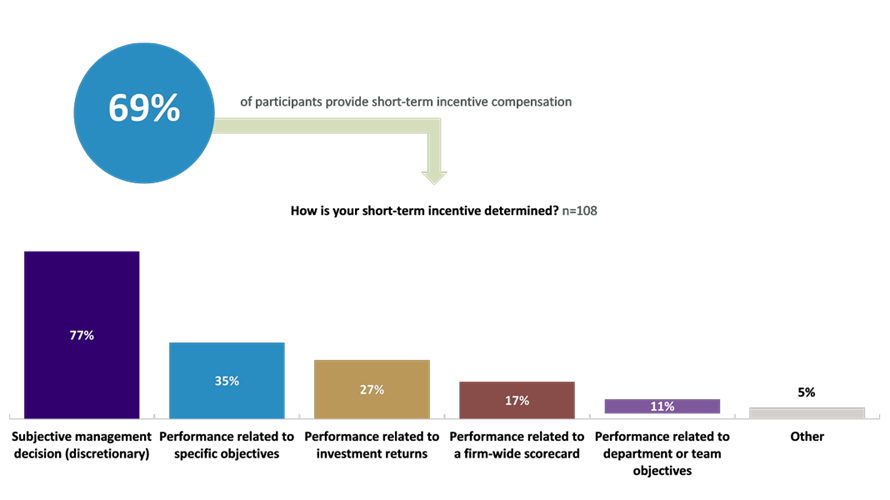

- Annual bonus. Although annual bonuses tend to be discretionary (see chart below), annual bonuses are useful if there are certain specific objectives that leadership would like to see achieved. For example, specific HR or operational objectives are common.

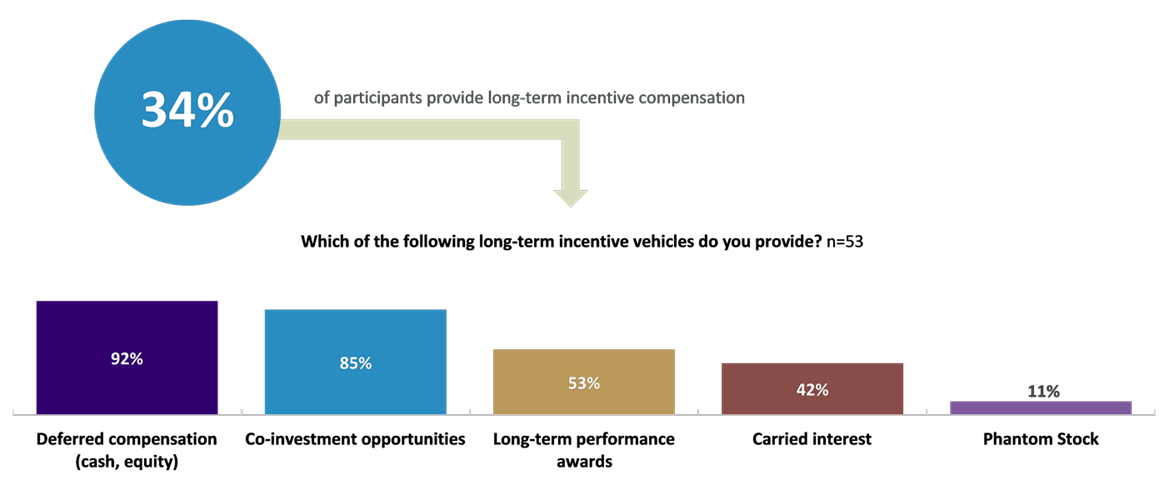

- Long-Term Incentive Plans (LTIPs). These plans intend to incent and retain talent by enabling them to create wealth alongside the family through metrics that align professionals with owners. More recently, family offices have begun to allow (or even require) their senior-most executives to co-invest (with their own funds or funds lent by the family office), which cultivates a sense of ownership and further aligns the interests of all parties.

- Vesting. Due to the long-term nature of successful initiatives/transactions, family offices often require several years of vesting even after value has been created.

It is interesting to note how many family offices report currently having short-term and long-term incentive programs.

The following two charts (per the 2018 FOX Compensation and Benefits Survey) illustrate the prevalence of short-term and long-term incentive programs at family offices:

Source: 2018 FOX Family Office Compensation & Benefits Survey

Source: 2018 FOX Family Office Compensation & Benefits Survey

Tax considerations

Developing an executive compensation plan can also take advantage of cutting-edge income and estate tax considerations. In public companies, except in rare circumstances, taxation on compensation is at ordinary income rates. Family offices can, in most circumstances, take advantage of capital gains taxation though the use of profits interests. Structuring of profits interests can be complicated; however, the potential tax savings can be substantial.

Compensation guidelines

Compensation practices within public companies are fully disclosed in public filings, which continue to become more detailed and robust; private company data that quantify executive compensation have become more accessible through subscriptions to aggregated databases. Thanks to surveys conducted and published by FOX and others, private company databases have expanded their reporting by geographies and executive level. Family offices with boards of advisors and those with family-dominated boards of directors often cite those resources as guidelines for gaining approval for high-level compensation for talented non-family executives.

Family office culture

Many talented executives come to work for family offices after success in other leadership roles, viewing family offices as an attractive alternative to the institutional environment. The appeal lies in the implied relational culture and flexible work environment of a family office. However, talent is wise to test these assumptions when negotiating employment and related compensation; those assumptions may or may not end up becoming reality, and the actual type of work environment and expectations could affect how one negotiates compensation arrangements.

Organizational culture can also affect investment direction. On the outset, understanding the level of risk a family office has experienced and is comfortable with will also influence compensation levels.

Summary

Experienced leadership is essential to developing and implementing an investment philosophy and strategy—and developing a compensation structure that attracts, motivates and retains top talent should be front and center of a family office’s hiring practices. In order to compete in today’s employment landscape, it is vital to align a compensation structure that supports the unique strategy and vision of the family office.

###

Jarret Sues is a managing director and co-leads the executive compensation and corporate governance practice at FTI Consulting. He specializes in creating compensation plans for public and private entities and can be contacted at jarret.sues@fticonsulting.com.

Mark Rubin is a senior managing director in the Private Client Tax and Advisory Services group and leads the Family Enterprise Services practice at FTI Consulting. He specializes in long-term income and estate tax compliance and planning, as well as governance planning for families and can be contacted at mark.rubin@fticonsulting.com.

David Toth is a managing director with Family Office Exchange. He oversees Research and Insights and Wealth Advisor practices. He also serves as co-leader of the Strategic CIO, MFO and Wealth Advisors Councils.

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals.

FTI Consulting, Inc., including its subsidiaries and affiliates, is a consulting firm and is not a certified public accounting firm or a law firm.

©2019 Family Office Exchange. All Rights Reserved. Except as expressly permitted in the CLA, Licensee shall not modify or create derivative works from this FOX publication without the express written consent of FOX. Licensee may not remove, obscure, or modify any copyright or other notices in the FOX publications. The views contained within this publication are those of the authors at the time of writing.