In recent years, the Higher Education team at Nixon Peabody LLP has noted the increasing frequency of transitions consisting of mergers, acquisitions, affiliations, and other institutional reconfigurations among higher education institutions (HEIs). The velocity is only increasing with the impact of COVID-19. As the number and awareness of such transitions increases, institutional administration and trustees are forced to consider whether such a transition might make sense for their organization. Even if the answer to the question may well be “no,” the very posing of the question is likely to sharpen the focus of the fiduciaries when considering the organization’s short and longer term future.

Operating conditions

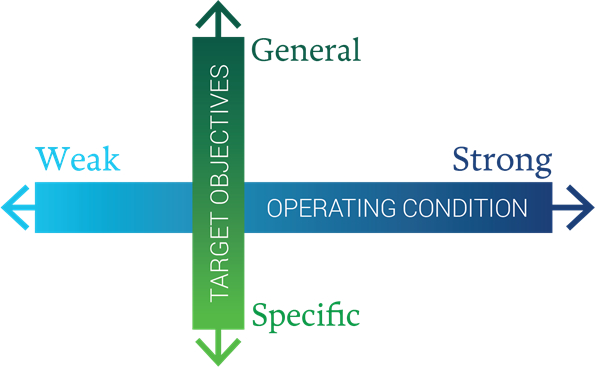

The conditions leading to HEI transitions are as varied as the institutions themselves. The one constant is a perceived need at the highest levels of the entity to adapt and change. Against this, each HEI has multiple layers of characteristics that inform the consideration of a possible transition, such as the fulfillment of the HEI’s target objectives in light of current and projected operating conditions. Even two seemingly similar public universities within the same state can have greatly varying operating conditions in terms of financial health, endowment funds, culture, prestige, and student population. The same is true of both private non-profit and for-profit colleges. Even though a variety of conditions can inform the decision to transition, financial strength stands out as a major factor. Most HEIs fall along a spectrum based primarily on financial strength. HEIs in a weak financial position are likely to have fewer options and thus less leverage than financially sound institutions. As a result, this weak financial position is likely to dictate the type of transition activity for that HEI, if any. In contrast, HEIs in a strong financial position have less need to prioritize financial support and can focus on making targeted acquisitions that meet their specific needs.

Moreover, the mere desire to pursue an affiliation needs to be measured against the institutional will and resources of both participating institutions. Mergers and acquisitions are not a skill set or experience common to HEIs, and the effectiveness of a combination of any size is based substantially on the ability of the two participating organizations to work together.

Target objectives

Although the baseline objective of all HEIs is educating students, HEIs adopt a variety of distinct strategies to fulfill that mission. Not all educational target objectives are the same, and the trends in transition activity confirm that HEI strategies range from solving specific challenges to achieving the most general of objectives. Specific objectives can be understood to mean that an HEI seeks one granular outcome, such as adding one particular type of degree program or shifting programs and practices to attract a specific group of students. Occasionally, the combination and culmination of those specific objectives may require institutional change at the highest level, such as merging the operations of a smaller institution into another and providing for shared governance in a new model.

HEIs are urged to exhaustively consider their list of “must haves” in any form of affiliation and recognize that factors outside that list will require flexibility. Moreover, the inability to create and convey those core elements to a prospective partner—as well as the prospective partner’s failure to fully appreciate the “must haves”—are fatal flaws in any combination opportunity. Institutions tempted or advised to skip the discipline of entering into a non-binding letter of intent proceed at their own caution.

Framework

An HEI’s operating condition and target objectives can be thought of on a spectrum, with operating conditions falling between weak and strong and target objectives falling between general and specific. As depicted below, combining the two factors forms a coordinate plane with four quadrants, which offers a framework for HEIs to conceptualize the appropriate transition activity for them.

The continuum of integration

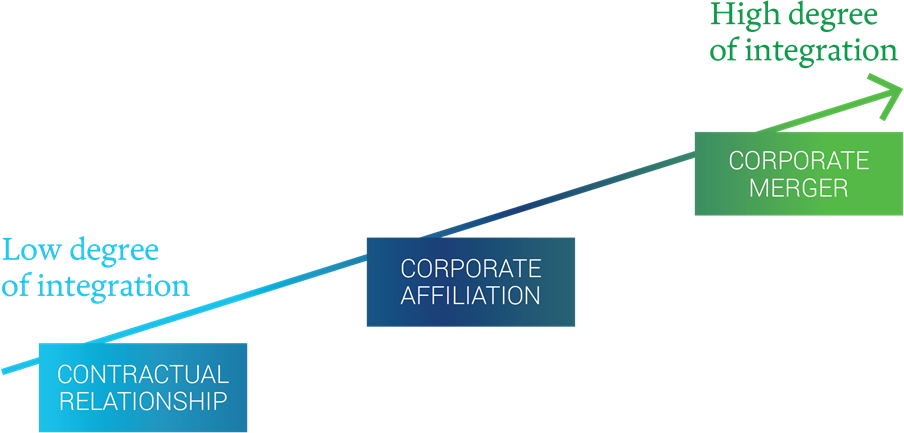

Simultaneously, HEIs need to consider the range of affiliation opportunities available to them, again expressed graphically as a point along a continuum. Our experience has been that a bias toward the lowest level of necessary integration provides the strongest perspective on how best to consider any affiliation proposal. The resting spot for affiliation should be a compelling result, not a mere “nice to have.” Otherwise, the transactions costs, especially those arising from an administrative shift from regular operations, are too substantial.

When should HEIs consider a transition?

The overall trends in higher education show that most HEIs have faced growing financial pressures for years. The issues are well known to governing boards and administration. The COVID-19 pandemic has converted what has been a broad strategic planning exercise into a 12-to-18-month plan for continued relevance. The “build it” option is thus more constrained, while a “buy it” option is available to only the most fiscally stable institutions. As a result, some form of strategic transition, such as a merger, acquisition, or affiliation, becomes more plausible and the possibility should be considered now.

In our experience, institutional governing boards come to these realizations often too late. An institution looking for affiliation partners with a clear set of stated objectives and sufficient resources to make the affiliation a success will be in a position to have better and more fruitful consideration than an institution that has perhaps unintentionally shortened the runway necessary for success.

The following deals provide three examples in which HEIs addressed these pressures through a transition.

An opportunity to strengthen operations

In the case of Wheelock College, a centuries-old private college in Boston, the institution had a well-defined mission, but was struggling to attract students. The combination of a declining applicant pool coupled with higher tuition costs was an admittedly unsustainable combination. Wheelock first identified institutions it thought could be a good match for a merger partner and provided a clear message: it sought a partner to help support its mission of providing high-quality education for future teachers and educational leaders. When Wheelock and Boston University joined in June 2018 and BU assumed Wheelock’s property and assets, Wheelock then became BU’s Wheelock College of Education & Human Development. Now, Wheelock continues to fulfill its mission and maintains its location in Boston, while BU incorporated a valuable specialized college into its offerings to prospective students. This is one example of an HEI with a general objective positioned in a weaker operating condition because of financial distress, which was then successful in extricating itself from its woes and emerged stronger within a new merged entity.

Expand market reach

In early August 2020, the University of Arizona acquired the assets of a for-profit institution focused on online learning to broaden the university’s online reach. One of the university’s long-term goals was to grow its online offerings, so this acquisition was one method to implement its strategy. Since the acquisition, the University of Arizona is now reportedly one of the largest online education providers in the United States. As a result, the university is now better positioned to attract and educate more non-traditional and international students. This is an example of an HEI with a strong operating condition and a specific objective. Because the university had a somewhat narrow objective—to grow online learning capabilities—it makes sense that they could achieve their goal through a more tailored acquisition.

Diversity of educational offerings

Higher education deals can help institutions diversify their degree programs. For example, in 2019, the University of Illinois Chicago and the John Marshall Law School merged. Both institutions came to the table with different goals: John Marshall faced empty seats and declining enrollment, while UIC sought to diversify its degree programs. At that time, there were no public law schools in Chicago and UIC was the only university in the University of Illinois system without a law school. As a result of the merger, UIC can now offer more dual degree programs and improve its cross-educational learning opportunities within its new college of law. UIC is an example of an HEI in a relatively strong financial position that achieved its very specific objective through a transition. On the other hand, John Marshall is an example of an HEI in a relatively weak financial position that also achieved its general objective through a transition.

As financial pressures and other challenges mount, we should expect the number of HEIs engaging in strategic transitions to increase. These types of transactions are quite complex and can be difficult to navigate, but can also offer institutions—both those in strong financial shape and distressed—a chance to survive and grow. Nixon Peabody lawyers combine deep experience in higher education affiliations to advise our clients during these transitions.