On Wednesday evening, Senators Chuck Schumer and Joe Manchin announced that they had reached a deal to spend $369 billion dollars on energy and climate change programs, including the creation of a new clean hydrogen tax credit. The clean hydrogen tax credit — which is part of a broader spending and deficit reduction bill titled the Inflation Reduction Act of 2022 (IRA) and would appear as a new Section 45V of the Internal Revenue Code — is structured in a similar manner to the hydrogen tax credit included in various iterations of President Biden’s proposed Build Back Better Act (BBBA). If passed, the clean hydrogen tax credit would provide a key revenue source for domestic clean hydrogen production projects and could make this emerging low-carbon fuel source cost competitive with hydrogen produced through steam-methane reforming.

The Inflation Reduction Act’s Clean Hydrogen Tax Credit or 45V

As with the BBBA clean hydrogen tax credit, the version included in the IRA is structured as a 10-year production tax credit based on the kilograms (kg) of qualifying hydrogen produced at a facility that begins construction prior to January 1, 2033. The base credit amount is set at $.60 per kg of clean hydrogen produced but will be multiplied by five to $3 per kg of hydrogen produced if prevailing wage, hour, and apprenticeship requirements are met in constructing, altering, or repairing the clean hydrogen facility. Perhaps most significantly, under the IRA, clean hydrogen production facilities may elect to receive direct payment in lieu of the tax credit.

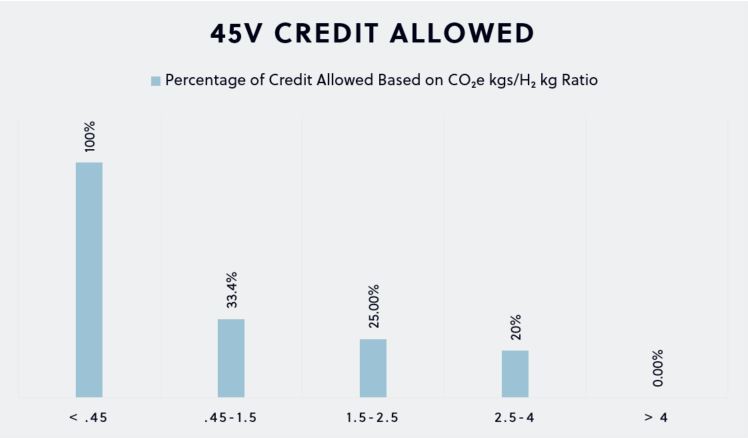

To be eligible for the clean hydrogen tax credit, a facility must produce hydrogen through a process that results in lifecycle greenhouse gas emissions of less than 4 kg of CO2-equivalent emissions (CO2e) per kg of hydrogen produced. The 4 kg of CO2e is, however, the floor for hydrogen to qualify as clean and will only provide a facility with 20% of the clean hydrogen tax credit. To qualify for the full $3 of the credit, a hydrogen production facility must produce hydrogen through a process that results in lifecycle greenhouse gas emissions of less than .45 kg CO2e per kg of hydrogen. The credit then steps down — rather dramatically — to 33.4% for hydrogen production facilities that produce hydrogen in the .45 to 1.5 kg CO2e range. The percentage of the credit a hydrogen production facility qualifies for is further reduced as emissions intensity of the hydrogen increases until it reaches the 4 kg CO2e floor, at which point, it no longer qualifies for any credit.

This following chart depicts the proposed clean hydrogen credit’s applicable percentages as they relate to the CO2e kg-to-hydrogen-kg ratio.

The IRA’s version of the clean hydrogen tax credit is less generous than previous versions in the BBBA in that it both sets a higher floor for hydrogen to qualify as clean (4 kg CO2e as opposed to 6 kg CO2e) and scales down the applicable percentage more rapidly. The IRA allows clean hydrogen production facilities to elect to receive a less generous investment tax credit rather than the production-based credit.

The IRA clarifies that the clean hydrogen tax credit may not be taken by a taxpayer for hydrogen produced at a facility that is also currently receiving or ever received the Section 45Q credit for carbon capture. In other words, a blue hydrogen production facility cannot generate credits for both its production of low-carbon hydrogen and for the carbon it captures and sequesters or uses. The IRA does, however, expressly allow clean hydrogen facilities that produce hydrogen using electricity produced by wind, solar, or nuclear facilities to receive both the clean hydrogen tax credit and the clean energy credit that the wind, solar, and nuclear facilities are eligible to receive. For example, a green hydrogen production facility that is co-located with a wind project can receive the 45V credit for the qualifying kgs of clean hydrogen it produces and a production tax credit under Section 45 for the kilowatt hours of electricity the wind project generates to produce the green hydrogen.

While the IRA has not yet passed either body of Congress yet, the fact that the clean hydrogen tax credit is included (with direct pay) in the IRA and has the support of Senator Manchin is an extremely positive sign for the nascent clean hydrogen industry.